The best time to start forming good financial habits when you’re young. Bad habits, like living beyond your means, can be very difficult to break as you get older.

Pay Yourself First

One of the best financial habits you can start early is to “pay yourself first”. This means saving first and spending what’s left, which is the opposite of what many people find themselves doing. Many well-meaning savers often find they get to the end of the money before they get to the end of the month.

Make it Automatic

To make sure that you do pay yourself first, consider setting up an automatic transfer between your chequing account (where your paycheque or other regular amounts get deposited) and a separate savings or investment account, like a Tax Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP). You can schedule the transfer to take place the day after you get paid and you can choose an amount to start that seems manageable. Putting your savings on “autopilot” takes the self-discipline out of the process - omething many people struggle with.

If you aren’t getting a regular paycheque, you can manually set aside a portion of any money that comes in - say 10% - and put it into a separate savings account.

You will get to a point where over time, you won’t even miss the money. Rather, you’ll be motivated to keep saving when you see your funds growing through the power of compound interest.

The Power of Compound Interest

Albert Einstein called compound interest the eighth wonder of the world: he who understands it, earns it; he who doesn’t, pays it. Compound interest means earning interest on your interest plus your original principal and the compounding effect accelerates over time.

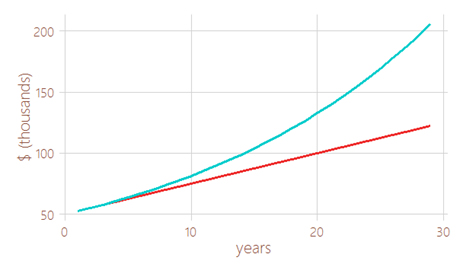

In the example below, the blue line represents compound interest and the red line represents simple interest (interest paid on your original investment principal only.) A $50,000 principal invested at 5% interest, compounded annually over 30 years, will grow to $216,097, which is $91,097 more than if only simple interest is earned. And the more frequent the compounding period, say monthly or daily, the faster your money grows.

Start Early

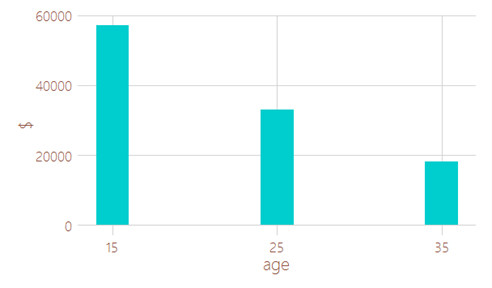

The best time to start saving and investing is when you’re young and the power of compounding can work for you for many years, even decades. Say you started saving $5 a week when you were 15. Assuming a 5% compound annual return, at 65, you’d have $57,152. But if you waited 10 years and didn’t start until you were 25, you would have $32,978.34 at age 65. And if you waited even longer, until you were 35 and saved for 30 years, you would only have $18,137.81.